boulder co sales tax rate 2020

Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax.

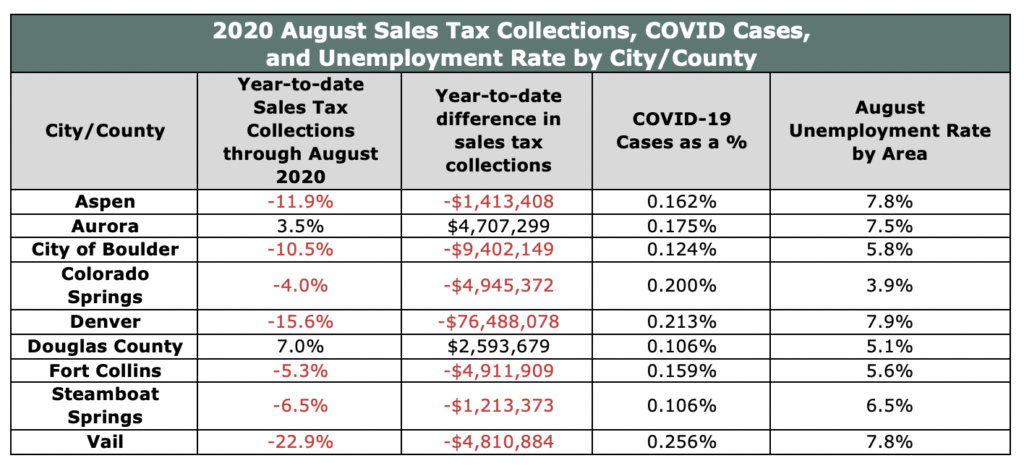

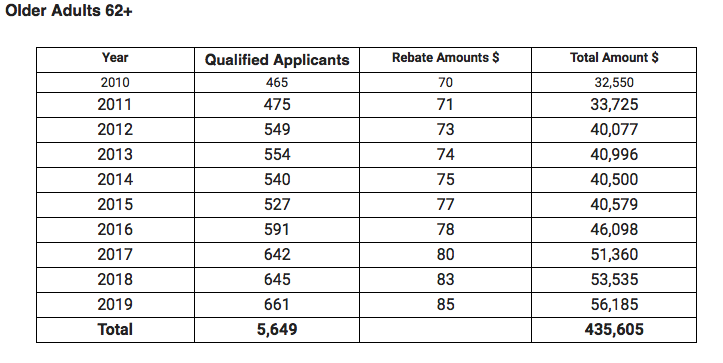

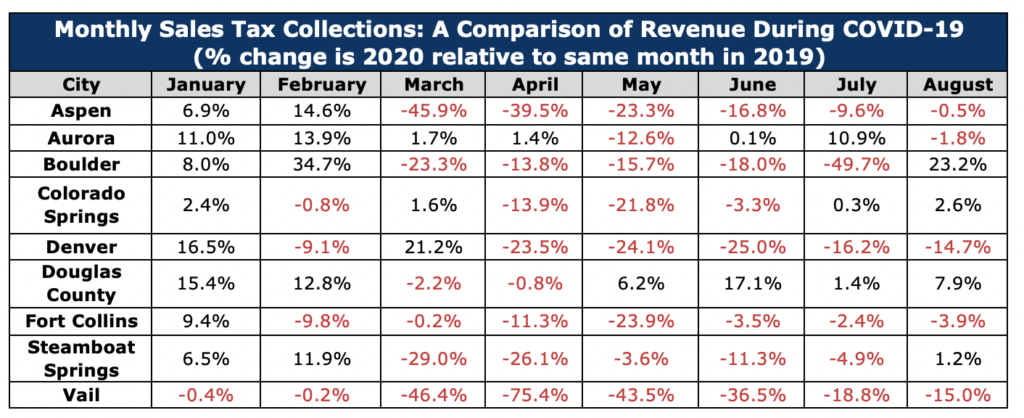

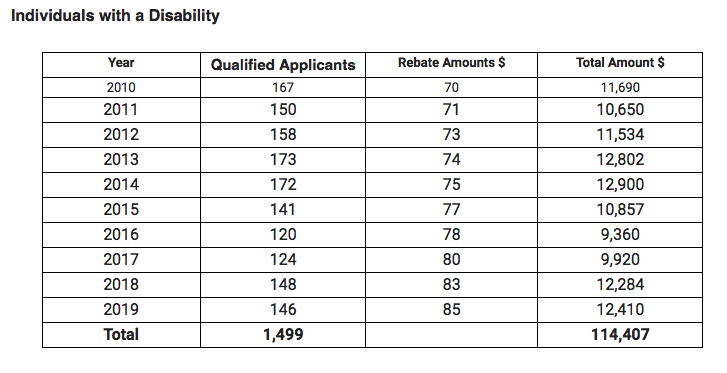

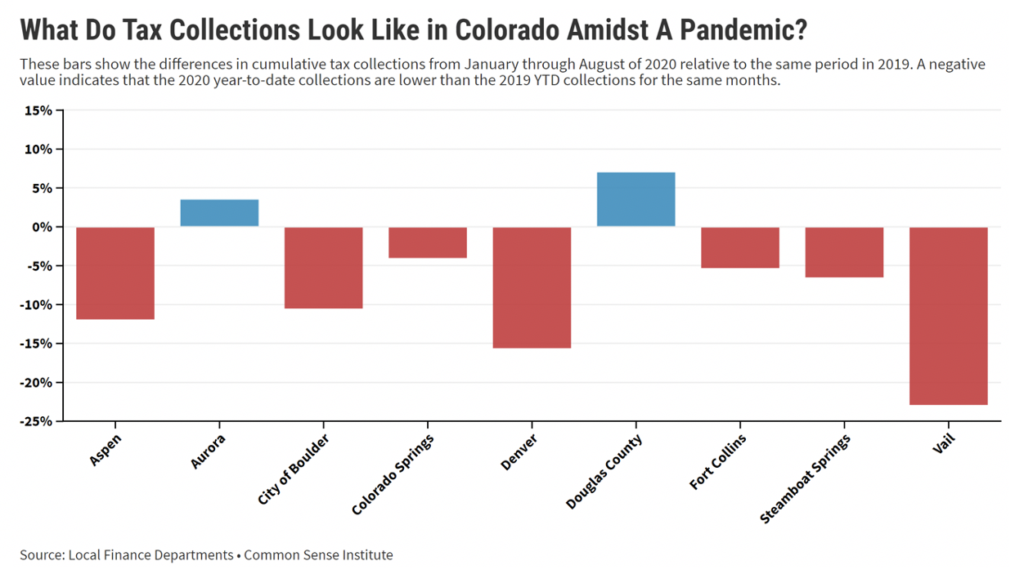

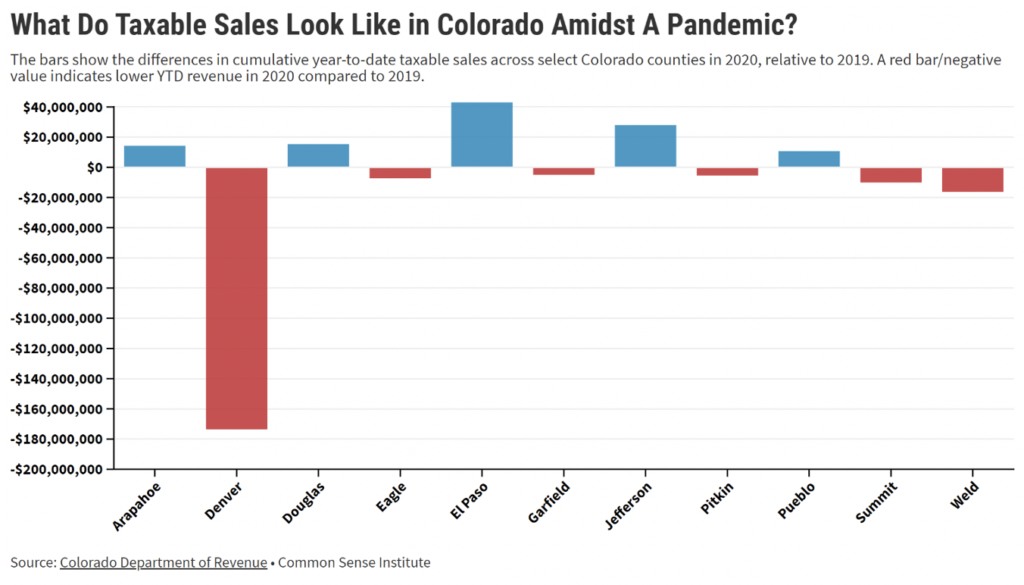

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Special event vendor rate charts 2018 manual rate chart 2018 food for home consumption only 201 7 manual rate chart This is the total of state county and city sales tax rates.

. Para asistencia en español favor de mandarnos un email a. August 5 2020 51240000 Series 2020 Tax-Exempt Fixed Rate Bonds Objectives Given favorable market conditions Boulder aimed to take advantage of low interest rates to convert intermediate debt to long-term fixed reimburse itself for prior capital expenditures and remediate a portion of existing debt used to finance assets at risk of. 2055 lower than the maximum sales tax in co.

The minimum combined 2021 sales tax rate for Frederick Colorado is. Including audit revenue total sales and use tax increased from 2020 by 1657565 or 1829. 2055 lower than the maximum sales tax in CO.

January 2020 retail sales tax revenue was down 918 compared to January 2019 revenue including audit revenue and the additional recreational marijuana sales tax. The County sales tax rate is. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501.

For tax rates in other cities see Colorado sales taxes by city and county. How to Apply for a Sales and Use Tax License. The state salesuse tax rate is 29 with exemptions A B C D E F G H K L M N O.

The Colorado sales tax Service Fee rate also known as the Vendors Fee is 00333 333. The sales tax jurisdiction name is Santa Cruz County Tourism Marketing District which may refer to. The 80303 boulder colorado general sales tax rate is 8845.

This is the total of state county and city sales tax rates. Boulder CO Sales Tax Rate. 1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee.

The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. The 9 sales tax rate in Boulder Creek consists of 6 California state sales tax 025 Santa Cruz County sales tax and 275 Special tax. Month-Over-Month Change in Retail Taxable Sales.

The minimum combined 2022 sales tax rate for Boulder Colorado is. CD 010 Applies to all sales that are Cultural Facilities District subject to RTD tax County of Boulder 0985 Sales Tax Use tax on Building Materials and Motor Vehicles Open Space 0475 0125 ending 123134 010 ending. 2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County.

Tax is remitted on the DR 0100 Retail Sales Tax Return. Boulder County CO Sales Tax Rate. The Boulder Sales Tax is collected by the merchant on all qualifying sales.

It also contains contact information for all self-collected jurisdictions. The 2020 Boulder County sales and use tax rate is 0985. The Colorado sales tax rate is currently.

The current total local sales tax rate in Boulder County CO is 4985. Did South Dakota v. The city of boulder will no longer mail returns after jan.

This document lists the sales and use tax rates for all Colorado cities counties and special districts. As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components. The December 2020 total local sales tax rate was 8845.

This is the total of state county and city sales tax rates. Return the completed form in person 8-5 M-F or by mail. The Frederick sales tax rate is.

The December 2020 total local. The Colorado sales tax rate is currently. The 2020 boulder county sales and use tax rate is 0985.

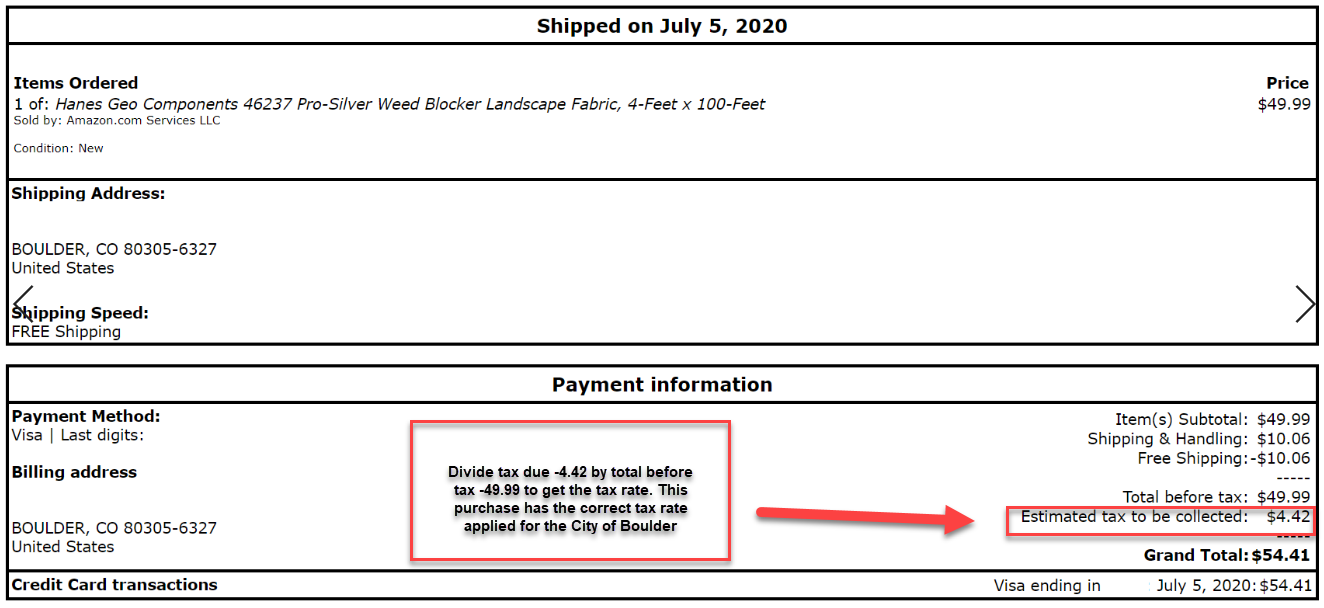

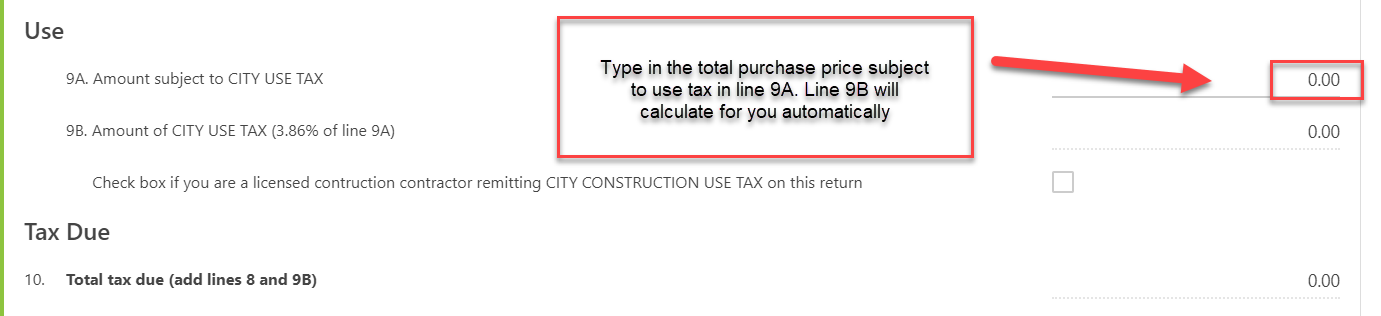

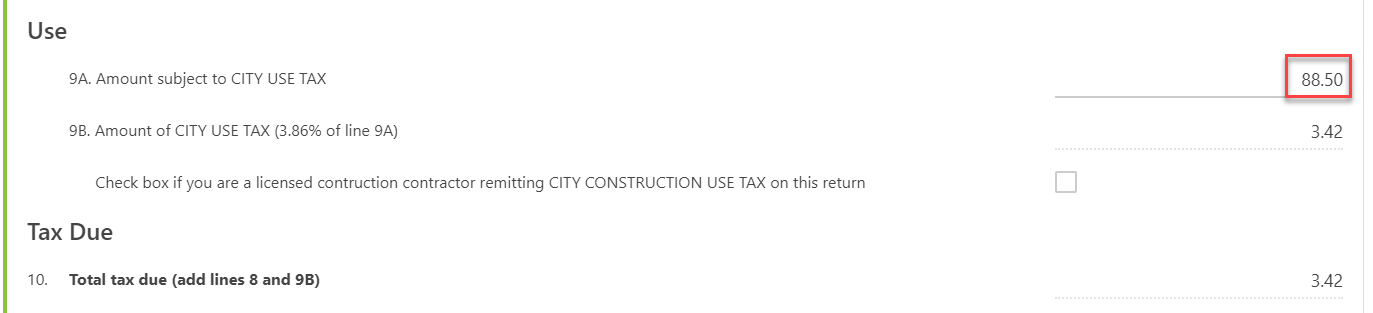

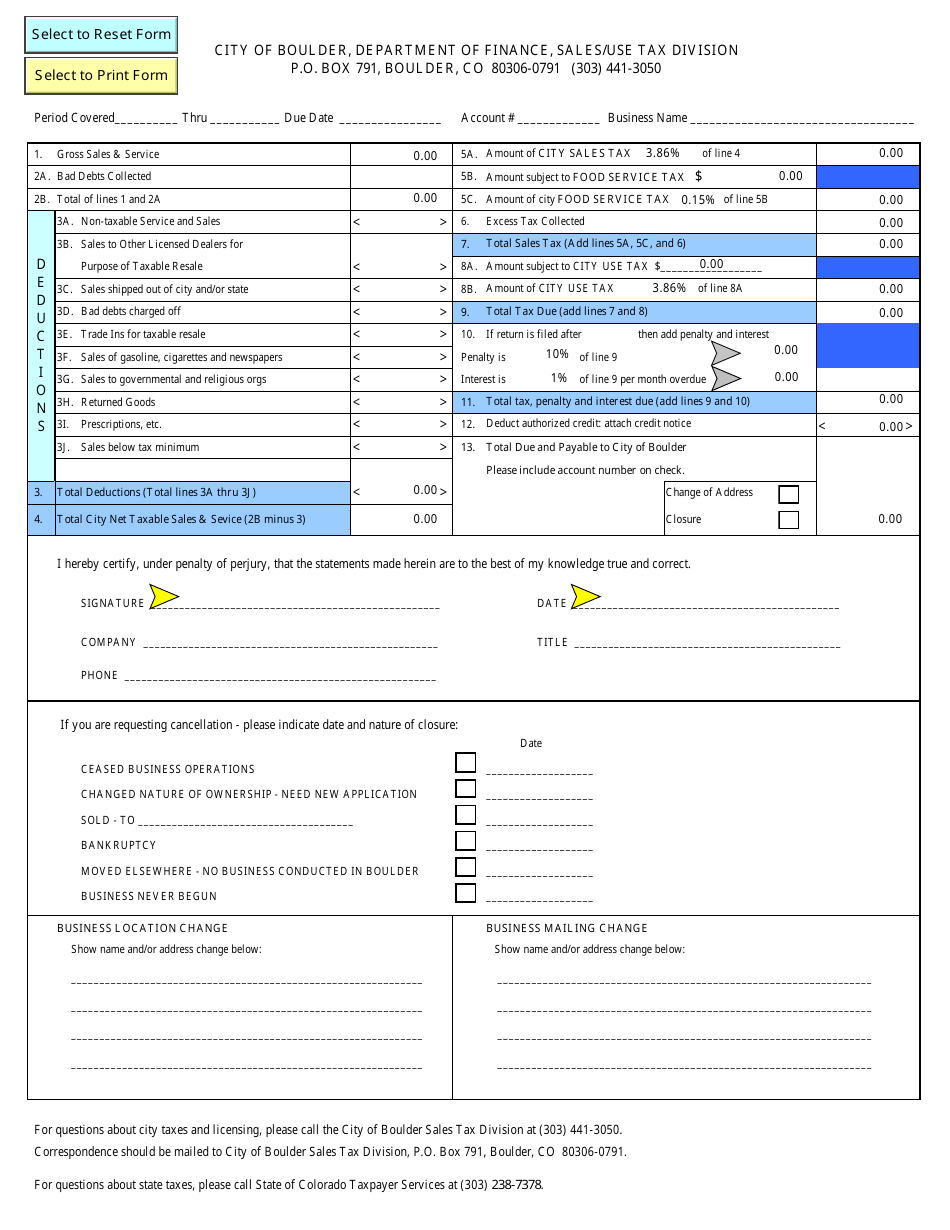

Wayfair Inc affect Colorado. Current City of Boulder use tax rate is 386. If your business is located in a self-collected jurisdiction you must apply for a sales tax account with that city.

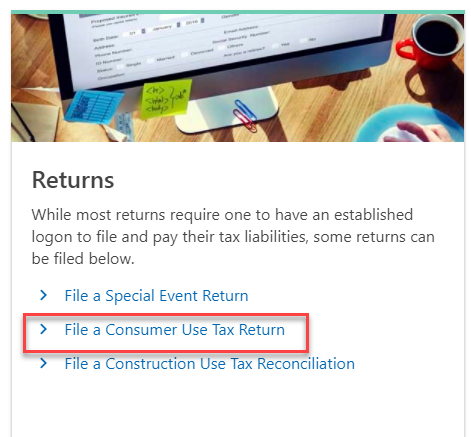

July to December 2020. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. 5 Food for home consumption.

4 Sales tax on food liquor for immediate consumption. The Boulder sales tax rate is. About City of Boulders Sales and Use Tax.

The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offe nder management nonprofit capital. You can print a 8845 sales tax table here. The County sales tax rate is.

This is the total of state county and city sales tax rates. The boulder colorado general sales tax rate is 29. The ESD tax is on top of the City of Boulder sales tax rate of 386.

There is no applicable city tax. Salestaxbouldercoloradogov o llamarnos a 303-441-4425. 2055 lower than the maximum sales tax in co.

Bond Sale Date. 3 Cap of 200 per month on service fee. The current total local sales tax rate in Boulder CO is 4985.

Boulder County Niwot Lid.

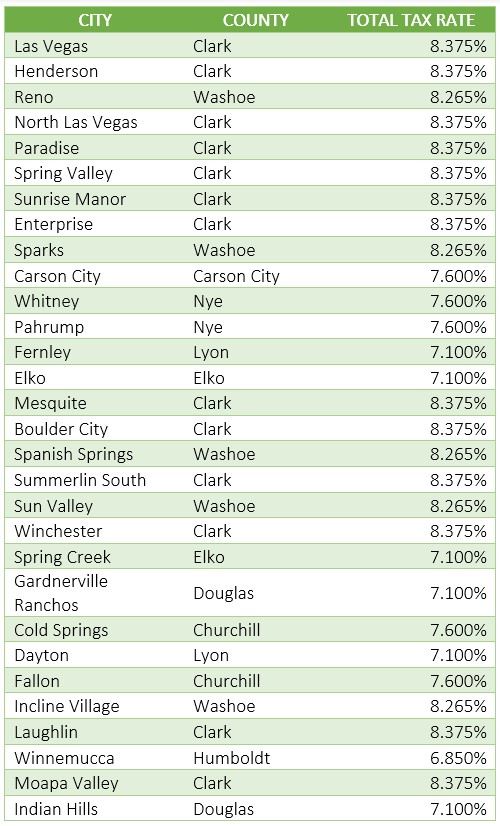

Nevada Sales Tax Guide For Businesses

Colorado Sales Tax Rates By City County 2022

Cience Debuts At 31 In The Financial Times Americas Fastest Growing Companies 2020 Send2press Newswire Financial Times How To Start Conversations Financial

Should Boulder Do Away With Sales Tax On Groceries Boulder Beat

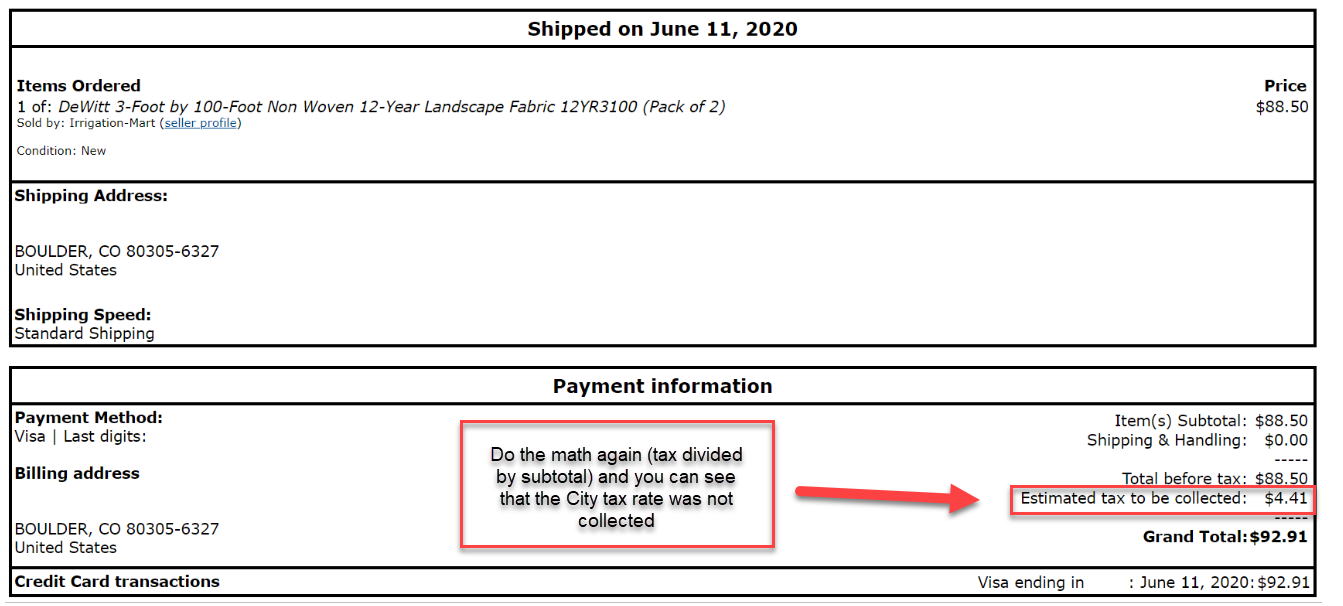

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Should Boulder Do Away With Sales Tax On Groceries Boulder Beat

Taxes In Boulder The State Of Colorado

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales And Use Tax City Of Boulder

Boulder Exploring New Taxes Fees As Revenues Falter Boulder Beat